Navigating Financing Options for Commercial Truck Purchase

Date: 29/11/2023

The South African commercial transport industry is a vital backbone of the country's economy, facilitating the movement of goods across vast distances. Whether you're a seasoned transport business owner or an entrepreneur just stepping into this thriving sector, the importance of securing a reliable commercial truck is undeniable. However, procuring these vehicles often requires substantial capital. In this article, we will explore various financing options available in the South African market to help you make informed decisions when it comes to your commercial truck purchase. Read more articles about trucks on Truck & Trailer blogs.

A look on Various Financing Options for Commercial Truck Purchase

1. Traditional Bank Loans

Traditional bank loans are a common choice for business owners looking to finance the sale of commercial trucks. South African banks offer competitive interest rates and various term lengths, allowing you to tailor the loan to your specific needs. To secure a bank loan, you'll typically need a strong credit history and a solid business plan.

Pros:

- Competitive interest rates

- Flexible repayment terms

- Potential tax benefits

Cons:

- Strict lending criteria

- Lengthy approval process

2. Asset Finance

Asset finance is a popular option for financing commercial vehicles in South Africa. This method allows you to acquire the equipment you need while spreading the cost over a set period. The equipment itself serves as collateral for the loan, making it easier to qualify for asset finance even if your credit history is less than perfect.

Pros:

- Easier approval process

- Preserve working capital

- Flexible terms

Cons:

- Ownership transfer upon full repayment

- Higher interest rates compared to traditional loans

3. Lease Financing

Lease financing is an attractive option for those who prefer not to take ownership of the commercial truck immediately. With a lease, you essentially rent the equipment for a specified period, and at the end of the term, you can choose to purchase it at a predetermined price or return it.

Pros:

- Lower initial outlay

- Predictable monthly payments

- Flexibility at the end of the lease

Cons:

- Limited customisation options

- You may pay more in the long run

4. Dealership Financing

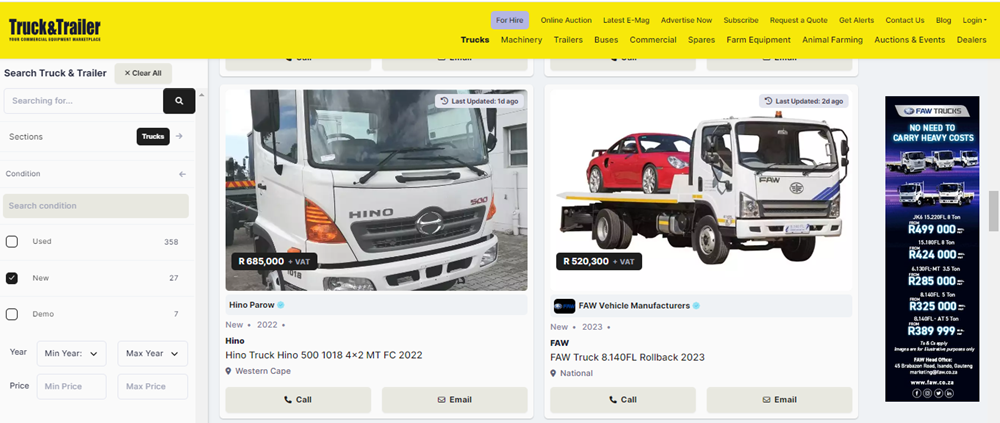

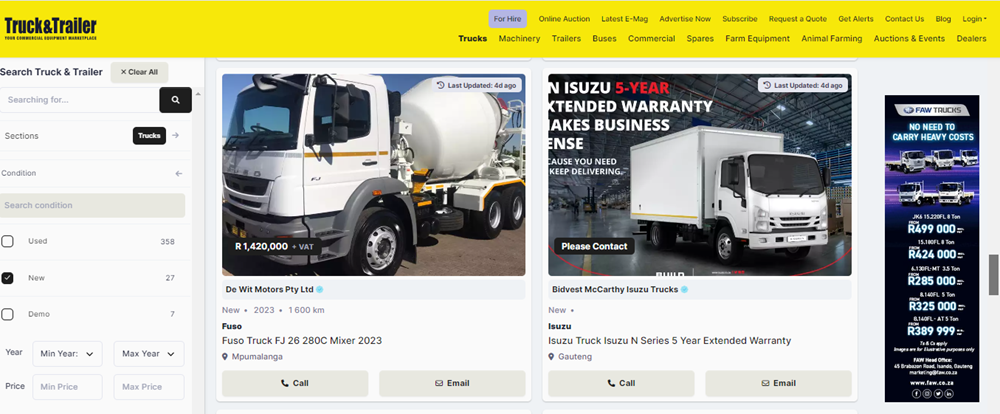

Many commercial truck dealerships in South Africa offer in-house financing options. These programs are specifically tailored to the vehicles they sell, making it a convenient choice for buyers. Dealership financing may have less stringent credit requirements compared to traditional banks.

Pros:

- Convenient one-stop shopping

- Knowledgeable staff

- Specialised financing packages

Cons:

- Interest rates may be higher

- Limited selection to the dealership's inventory

5. Trade-In Options:

Some dealerships and financing institutions may offer trade-in options, allowing businesses to exchange their existing vehicles for a reduction in the cost of a new commercial truck. This can be a practical solution for businesses looking to upgrade their fleet while minimising the financial impact.

Pros:

- Reduces the cost of a new truck.

- Simplifies the upgrade process.

- Potential tax advantages.

Cons:

- Trade-in value may not cover the full cost.

- Limited to the dealership's offerings.

- Dependent on the condition of the trade-in vehicle.

6. Government Funding Programs:

In some cases, businesses may qualify for government funding programs aimed at supporting the growth of the commercial sector. These programs may offer favorable terms and conditions to businesses meeting specific criteria, providing an additional avenue for financing.

Pros:

- Favorable terms and conditions.

- Financial support for businesses meeting specific criteria.

- Potential for grants or subsidies.

Cons:

- May have strict eligibility requirements.

- Limited availability and competition for funding.

- Application process can be time-consuming.

7. Supplier Financing:

Certain truck manufacturers and dealerships provide in-house financing options. This supplier financing allows businesses to streamline the purchasing process by obtaining financing directly from the supplier. This option often comes with specialised terms and conditions, providing a convenient one-stop solution for acquiring both the vehicle and financing.

Pros:

- Streamlines the purchasing process.

- Potential for manufacturer incentives.

- Convenience of a one-stop solution.

Cons:

- Interest rates may be higher.

- Limited choice of financing terms.

- May be tied to specific truck models.

When it comes to a Commercial Truck sale in South Africa, securing the right financing option is crucial for your business's success. Consider your unique financial situation, credit history, and long-term goals when choosing the best financing method. Whether you opt for traditional bank loans, asset finance, lease financing, or dealership financing, each has its own advantages and disadvantages. Take the time to assess your options, and you'll be well on your way to acquiring the commercial vehicles you need to drive your business forward. Your journey in the South African transport industry starts with making the right financial choices for your commercial truck sale. Visit the Truck & Trailer blogs to read more articles on trucks.